Table of Contents

I can remember my college graduation like it was two months ago. Which, quite frankly, it was. I stood alongside my peers, anxiously anticipating walking across the commencement stage. The many families and friends in the audience cheered as my name was called, and the President of the College theatrically shook my hand in congratulations. A photographer took my picture as I proudly held my diploma. “It’s over!” I thought, “It’s finally over!”

It most definitely was not over. The next day I received a reminder email from my dear friend Sallie Mae. The subject line read: “Important: your student loans are due soon.” Following this initial message were multiple follow-up emails, in case I forgot about the looming debt that was about to consume me.

Greetings From Reality

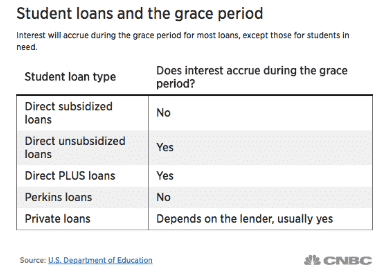

This has become the reality for thousands of college graduates across the country today. In 2016, the average college student graduated with a staggering $37,000 in student-loan debt. Today, 90% of student loans are provided by the federal government, which grants graduates a six-month grace period before repayment takes effect. Before graduates take a huge sigh of relief, it should be noted that for the majority of these loans, interest will accrue. This includes direct unsubsidized loans, direct PLUS loans, and some private loans. The high cost of higher education may have helped form what student’s goals are upon graduation.

How have student’s goals changed?

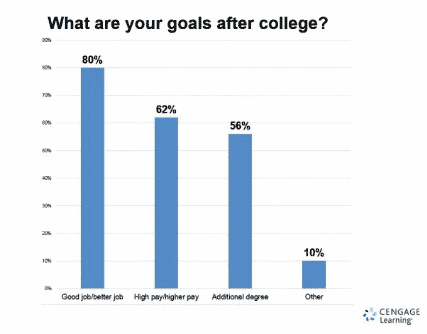

In the Spring 2015 Student Engagement Insight Survey conducted by CENGAGE Learning, 3,000 college students were asked about their ultimate goals and how the decision to pursue a higher education would help them get there. The responses made it clear that many attend college in hopes of gaining a fulfilling career to pay the bills. When asked “what are your goals after college?”, 80% responded that they want a good job or a job which is better than they have now. Unsurprisingly, the second most common response involved financial security. 62% of respondents hoped for a high salary or higher salary than what they currently have. The takeaway? Students hope to leverage their academic achievements to land a high-paying professional job. After all, having a college degree will lead to a life of prosperity. Right?

Underemployment

If only it were that simple. There has always been a great deal of press coverage on unemployment rates. This has led the conversation away from something much more common: underemployment.

As of June 2016, there is a 4.9% unemployment rate in the United States. One misconception is that all struggles disappear once these people become employed. Wrong. According to Forbes, 46% of the workforce report that they are underemployed. What exactly does this mean? Nearly half of workers in the United States are employed at a job that doesn’t fully utilize their skills or abilities

“In fact, the familiar assumption — graduate from college and

prosperity will follow — has been disproved in this century.”

-The New York Times

One major issue is that the economy is not producing enough high paying quality jobs to accommodate the sheer amount of college graduates that are looking to fill them. It’s easier, and cheaper, for companies to look offshore to fill positions. Other common professions, such as teaching, have low paying jobs and are experiencing massive layoffs. Within the past five years, there has been recent job growth, but these are in lower paying occupations. Postings for jobs that do not require a college degree have exceeded pacing for those that do, leaving college graduates struggling, and high school graduates lagging behind. This will certainly come as a surprise for the students that are swimming in thousands of dollars in debt, and have dreamed of financial stability immediately following their graduation.

This raises the question, is there anything that millennials can do to prepare better for college and set themselves up for success upon graduation?

Advice

This August as you drop your college student off for the first time, it may be wise to extend some guidance. After reading this article, you should be trying to get the most bang for your buck!

- Establish goals before arriving on campus: The majority of college and career counselors drive the focus on which college students should attend. This strategy builds barriers for undergraduates, resulting in ill-informed students that haven’t established goals for when they arrive on campus. While we don’t expect every student to show up on campus with the next four years of their life planned out, there is value to having a general idea of what you wish to accomplish and how it can help you in the future.

- Network, network, network: This bullet point is so important that we repeated it three times. College lends you the opportunity to begin building a professional network. Only 32% of freshman have discussed ideas with their professors outside of the classroom. This is a missed opportunity. Faculty are filled with wisdom and can help you get to where you want to be.

- Build quality friendships: Networking shouldn’t be limited to faculty. By building quality friendships, you are expanding your network. You never know; the friends who entered the workforce two years before you may have job leads, or can recommend you for an opening at their company.

- Take classes outside of your major: Employers are looking for candidates that have it all. In college, I knew of a computer science major who interned at a brewery the summer after her freshman year. You should be focusing on your major, but also building practical skills that will make you stand out from the crowd.

- Save your pennies: This goes without saying. If ever there was a time when you can save your money, it’s now. The federal government provides 90% of student loans with an interest rate of 4.29%. That $500 that you had in your savings could pay off the interest that accrued during your 6-month grace period.

Final Thoughts

- Is there anything you wish you were told when you were beginning your college career?

- Should we be teaching students to expect the worst?

- What do you think? Are millennials making informed decisions regarding their education?